National Pension System – How to open an online NPS account – Step by Step by procedure discussed.

Government of India under National Pension System Trust enables opening online account. The procedure for opening such account is given below:

- Opening of Individual Pension Account under NPS (only Tier I / Tier I & Tier II)

- Making initial and subsequent contribution to your Tier I as well as Tier II account

For Account opening, you need to:✔ Have a PAN Card, mobile number, email ID and an active bank account with enabled net baking facility

✔ Fill up all the mandatory details online

✔ Scan and upload your photograph and signature

✔ Make online payment (Minimum amount of Rs 500)

✔ Print the form, paste photograph & affix signature and submit the Form to CRA

Kindly note that the eNPS facility can not be used for enrolment under Atal Pension Yojana (APY).

Click here for online eNPS websiteTo open an Individual Pension account online.

National Pension Scheme Registration✔ You must have a ‘Permanent Account Number’ (PAN) and a Bank account with any of the registered Point of Presence empanelled for KYC verification for subscriber registration through NPS

✔ Your KYC Verification in NPS will be done by your Bank selected by you during the registration process.

✔ You need to upload your scanned photograph and signature in *.jpeg/*.jpg format having file size between 4kb – 12kb.

✔ You will be routed to a payment gateway for making the payment towards your NPS account from Debit / Credit card or Internet Banking.

After successful payment of initial contribution, a Permanent Retirement Account Number (PRAN) will be allotted to you. After online account opening process is completed,

➤ The PRAN Kit containing a PRAN Card, IPIN/TPIN, Subscriber Master Report, Scheme Information Booklet alongwith a Welcome Letter will be sent to your registered address.

➤ You need to take a printout of the form, paste your photograph (please do not sign across the photograph) & affix signature.

➤ You should sign on the block provided for signature.

➤ The photograph should not be stapled or clipped to the form.

➤ The form should be sent within 90 days from the date of allotment of PRAN to CRA at the following address or else the PRAN will be ‘frozen’ temporarily:

Central Recordkeeping Agency (eNPS),

NSDL e-Governance Infrastructure Limited,

1st Floor, Times Tower, Kamala Mills Compound, Senapati Bapat Marg,

Lower Parel, Mumbai – 400 013

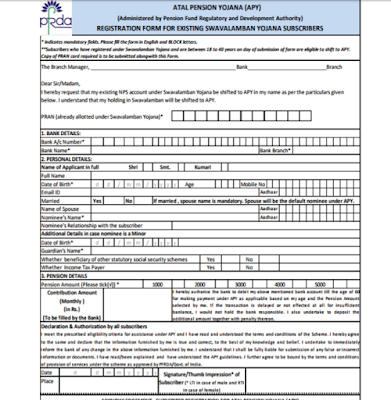

Please note that registration for APY cannot be done through www.enps.nsdl.com. For registration under APY please contact your Bank Branch.

Processing of subsequent nps contribution:

All existing subscribers (registered through both online and offline mode) can contribute in Tier I & Tier II account using ‘eNPS’. To contribute online, you need to

✔ Have an active Tier I / Tier II account

✔ Authenticate your PRAN using the OTP sent to your registered mobile number

✔ Pay through your Debit / Credit card or use Internet Banking option.

For queries please contact : 022 – 4090 4242 or write to: eNPS@nsdl.co.in