Atal Pension Yojana was introduced to benefit those people in the unorganised sector. The scheme provides financial security for old age and helps people deal with illness, accidents and diseases. The scheme also benefits private sector employees who are not given pension benefits by their company. Under this scheme, the investors get a fixed pension of Rs 1000, Rs 2000, Rs 3000, Rs 4000, or Rs 5000 on attaining an age of 60. The amount depends on the individual’s age and the contribution amount. Interestingly, Atal Pension Yojana had replaced the Swavalamban Yojana, which wasn't very popular among people.

According to the guidelines by the Government of India, the money invested through Atal Pension Yojana scheme is managed by the Pension Funds Regulatory Authority of India (PFRDA). The government would also make a co-contribution of 50% of the total contribution, or Rs 1000 per annum, whichever is lower, to all eligible subscribers who had joined between June 2015 and December 2015 for a period of 5 years i.e., for financial years 2015-16 to 2019-20.

Atal Pension Yojana eligibility:To get the benefits of Atal Pension Yojana, an individual must:

- Be a citizen of India.

- Be between the age of 18-40.

- Make contributions for a minimum of 20 years.

- Must have a bank account linked with Aadhar.

- Must have a valid mobile number

Atal Pension Yojana: How to apply?1. Visit any bank and start an account.

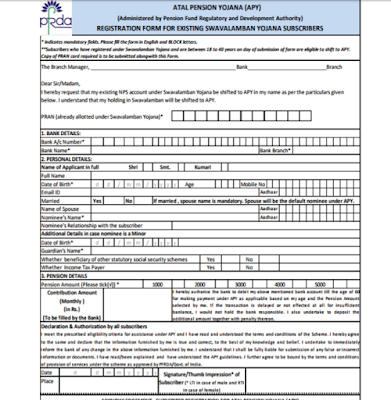

2. Download the Atal Pension Yojana form online. The forms are available in English, Hindi, Bangla, Gujarati, Kannada, Marathi, Odia, Tamil, and Telugu.

3. Fill the Atal Pension Yojana form and submit it to your bank along with mobile number and a photocopy of your Aadhaar card.

4. You will be sent a confirmation message when the application is approved.

Atal Pension Yojana monthly contributions:The investors have the option to make contributions for monthly/quarterly/semi-annual intervals. All the contributions are made through auto-debit facility from the savings account of the subscriber. This amount depends upon the amount of pension a subscriber wants to receive upon retirement.

Atal Pension Yojana income tax benefits:An individual can claim tax benefits up to Rs 1.5 lakh under section 80C as part of Atal Pension Yojana. Additionally, an income tax deduction of up to Rs 50,000 can be availed under the section 80CCD (1B) of the Income Tax Act of 1961.

Atal Pension Yojana important facts:- The subscribers can increase the premium at their will.

- In case you default on your payments, a penalty of Re 1 per month for a contribution of every Rs 100 or part thereof is levied.

- If the default continues for six months, the account is frozen.

- What is critical to know is hat early Atal Pension Yojana withdrawal is not entertained. The entire amount is only given in case of death or terminal illness.

https://www.zeebiz.com/personal-finance/news-atal-pension-yojana-eligibility-monthly-contributions-how-to-apply-tax-benefits-important-facts-apy-scheme-benefits-pfrda